self employment tax deferral covid

Real Estate Tax deferral program. Federal Aid Package Helps Individuals Affected by COVID-19 CARES Payroll Tax Deferral.

What Is Payroll Tax Deferral And How Does It Affect Small Businesses

In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self-employment.

. Most affected employers and self-employed individuals received reminder billing notices from the IRS. You can reasonably allocate 77500 775 x 100000 to the deferral period March 26 2020 to December 31 2020. IRS Releases Guidance on Employee Payroll Tax Deferral but Fails to Quell Concerns Over Implementation and Collection of Deferred Taxes.

Business Income Receipts Tax BIRT. Similarly self-employed individuals could defer up to half of the Social Security portion of the self-employment tax. If youre self-employed the coronavirus COVID-19 pandemic is likely impacting your business.

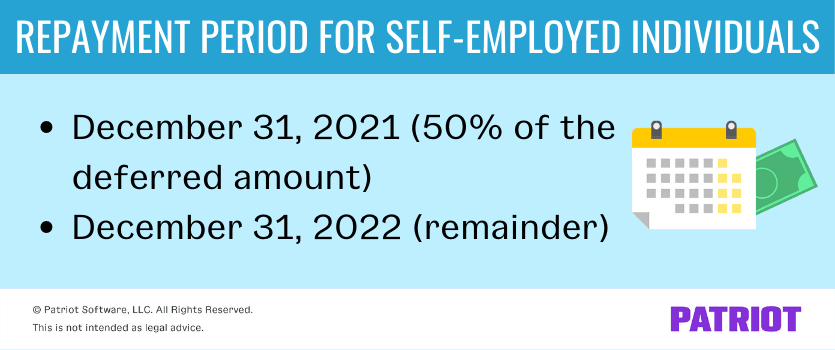

Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022. Section 2302 of the CARES Act calls this period the payroll tax deferral. It looks like I need to pick up 50 of that in 2021 and 50 in 2022.

Lets say your net self-employment earnings for 2020 are 100000. However if youre self-employed and dont have the safety net of traditional employment this period of uncertainty can be particularly. How a payroll tax relief deferral may help self-employed people.

Self-employed taxpayers can also postpone the payment of 50 of the Social Security portion of their self-employment tax for the same period. The Medicare portion of. The American Rescue Plan a new COVID relief bill passed the House and is going to the President to be signed into law.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. On 28 August 2020 the IRS issued eagerly awaited. It was last edited on August 23 2021.

Individuals that file Schedule C or Schedule H and were affected by the coronavirus COVID-19 may have been able to defer self-employment taxes. The provision lets you defer payment of the employer share 50 of Social. Workers filing for unemployment since March 2020 when the pandemic began in earnest.

31 2021 and the remainder is due by Dec. Self-Employment Tax Deferral on 2020 tax return. Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax.

The deferral effectively reduces the required amount to. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. You can get immediate access to the credit by reducing the employment tax deposits you are otherwise required to make.

However the deferred payments must still be made. This is a deferral rather than forgiveness so those amounts will eventually need to be repaid. I have a new client that has 6500 on Sched 3 - which is the SE tax deferral allowed in 2020.

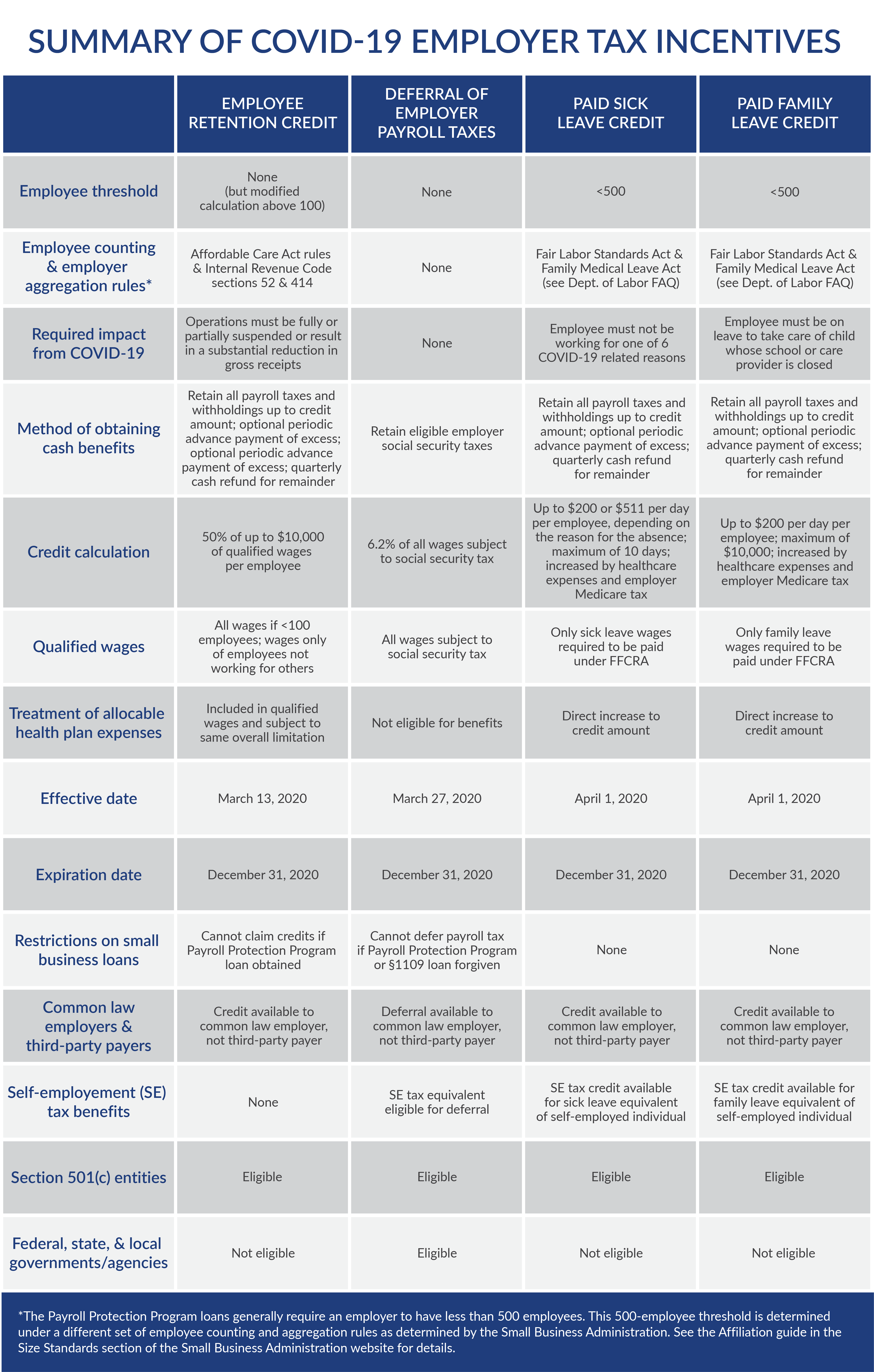

Report a paid sick leave violation. COVID-19 hospitalizations have. Employer of any size can defer its payment of employer Social Security 62 beginning March 27 2020 and ending December 31 2020.

If youre self-employed you know that the self-employment SE tax can take a big bite out of your wallet every year. This number represents only a fraction of COVID-19 cases in the city. The bill includes a third round of stimulus payments for millions of Americans.

Under the CARES Act employers were allowed to defer the employers share of the Social Security tax for part of 2020. COVID Tax Tip 2021-96 July 6 2021. Half of the deferred Social Security tax is due by Dec.

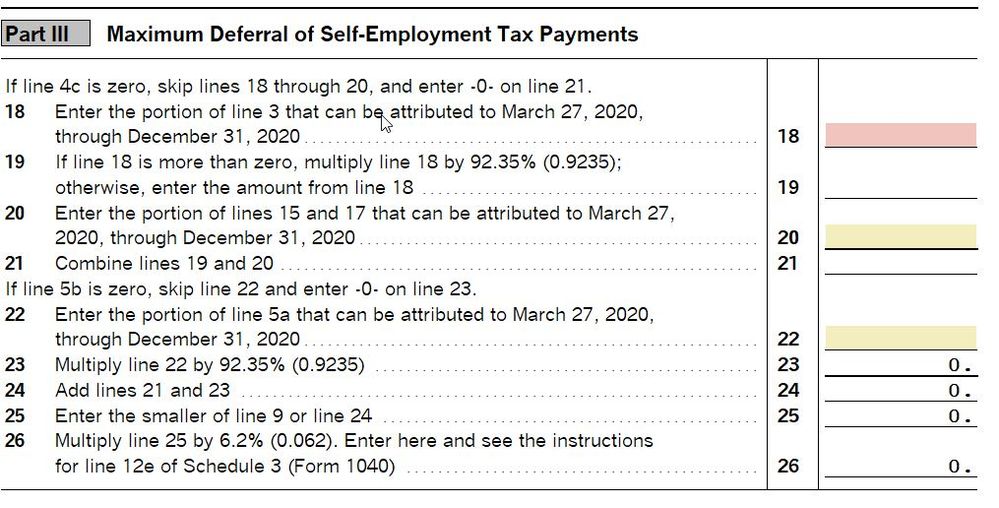

So you would be taxed on 7157121 77500 x 09235. This article refers to provisions covered under the CARES Act of 2020. WASHINGTON The Internal Revenue Service announced today that a new form is available for eligible self-employed individuals to claim sick and family leave tax credits under the Families First Coronavirus Response Act FFCRA.

As a self-employed individual only 9235 of your earnings are subject to social security tax. As one of the governments coronavirus COVID-19 supporting measures Self Assessment taxpayers were given the option of deferring payment of their July 2020 Payment on Account until 31 January. Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27 2020 and ending December 31 2020.

Self-Employed Tax Credit for Sick Leave. Under the Cares Act income earned between March 27 th and December 31 st. IR-2021-31 February 8 2021.

The Coronavirus Aid Relief and Economic Security CARES Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on Form 1040 for tax year 2020 over the next two years. Business self-employment. Defer some self-employment tax.

Pays employees who request up to 80 hours of leave for COVID-19 related self-care or care of others. Nearly all businesses and self-employed individuals were eligible for the employer payroll tax deferral. Community Development Corporation CDC Tax Credit.

Up to 2000 experienced call handlers are. The helpline allows any business or self-employed individual who is concerned about paying their tax due to coronavirus to get practical help and advice. Thankfully the Coronavirus Aid.

If you are self-employed you may be eligible for a refundable tax credit. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27 2020 and ending December 31 2020. The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave under the FFCRA.

The CoronavirusCovid-19 pandemic has caused financial strain for many Americans with more than 46 million US. IR-2021-256 December 27 2021 WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer paying part of their 2020 Social Security tax obligation that a payment is due on January 3 2022. The CARES Act funded financial assistance for self-employed and small businesses experiencing economic hardships caused by coronavirus COVID-19.

The Families First Coronavirus Response First Act which was passed March 18 provides relief in the form of refundable tax credits for sick leave and family leave for both eligible self-employed and small business owners.

Self Employed Social Security Tax Deferral Repayment Info

Pros Cons Of President Trump S Payroll Tax Deferral

Self Employment Tax Grubhub Doordash Instacart Uber Eats

What The Self Employed Tax Deferral Means Taxact Blog

Self Employed Social Security Tax Deferral Repayment Info

Deferral Of Se Tax Intuit Accountants Community

Employers Can Defer Payroll Taxes Cobb

How To Defer Social Security Tax Covid 19 Bench Accounting

Budgeting For The Payroll Tax Deferral 2020 Social Security Dave Ramsey Financial Coach

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

How The Coronavirus Payroll Tax Deferral Affects Pastors The Pastor S Wallet

Tax Deferral From 2020 Time To Pay Up Barbara Weltman

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Collection Of Deferred Social Security Tax Begins Jan 1 Wright Patterson Afb Article Display

Irs New Employer Tax Credits St Louis Economic Development Partnership

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

What The Self Employed Tax Deferral Means Taxact Blog

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community