vermont sales tax calculator

Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates. Sales Tax calculator Vermont.

Vermont Income Tax Calculator Smartasset

Vermont sales tax details.

. The registration application is received from a Vermont Dealer or a Vermont Dealer acting on behalf of the Lessor. These are only several examples of. Vermont has a 6 statewide sales tax rate but also has 153 local tax jurisdictions including.

The states top income tax rate of 875 is one of the highest in the nation. The Vermont Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Vermont in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Vermont. The Vermont VT state sales tax rate is currently 6.

Avalara provides supported pre-built integration. Numbers represent only state taxes not federal taxes. Depending on local municipalities the total tax rate can be as high as 7.

Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7. The average cumulative sales tax rate in South Barre Vermont is 6. This includes the rates on the state county city and special levels.

Find list price and tax percentage. Underpayment of 2020 Estimated Individual. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Vermont local counties cities and special taxation.

It is 3405 of the total taxes 34 billion raised in Vermont. If the individual purchases this vehicle at the end of the lease they will pay tax on the residuallease end value of the vehicle. The state sales tax rate in Vermont is 6.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Vermont has a 6 statewide sales tax rate but also has 207 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0092 on top of. Middlebury is located within Addison County VermontWithin Middlebury there is 1 zip code with the most populous zip code being 05753The sales tax rate does not vary based on zip code.

Then use this number in the multiplication process. The latest sales tax rates for cities in Vermont VT state. Vermont sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Calculator Fri 02192021 - 1200. Vermont has a progressive state income tax system with four brackets. Before-tax price sale tax rate and final or after-tax price.

Vermont sales tax reference for quick access to due dates contact info and other tax details. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. No Vermont cities have local income taxes.

Vermont sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. South Barre is located within Washington County VermontWithin South Barre there is 1 zip code with the most populous zip code being 05670The sales tax rate does not vary based on zip code. Vermont sales tax may also be levied at the citycounty.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Sales tax calculator Sales tax rate tables Check your nexus tool. 2020 IN-152 Underpayment Adjustment Calculator. 2022 Vermont Sales Tax Table.

How to Calculate Sales Tax. Sales and Gross Receipts Taxes in Vermont amounts to 12 billion. Calculator Mon 02082021 - 1200.

Sales tax data for Vermont was collected from here. Sales tax in Dover Vermont is currently 7. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Check your local Vermont sales tax rates using the TaxJar sales tax calculator. 2020 rates included for use while preparing your income tax deduction. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Vermont has a 6 general sales tax but an additional 10 tax is added to purchases of alcoholic drinks that are immediately consumed. A Purchase and Use Tax Computation - Leased Vehicle Form form VD-147 may be submitted in. Overview of Vermont Taxes.

If this rate has been updated locally please contact us and we will update. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tax Year 2021 State of Vermont Annualized Income Installment Method.

The Vermont Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Vermont in the USA using average Sales Tax Rates andor specific Tax Rates by. Rates include state county and city taxes. Find your Vermont combined state and local tax rate.

Vermont has 19 special sales tax jurisdictions. ICalculator US Excellent Free Online Calculators for. This includes the rates on the state county city and special levels.

Skip to main content. You can use our Vermont Sales Tax Calculator to look up sales tax rates in Vermont by address zip code. How much is sales tax in Dover in Vermont.

The state sales tax rate in Vermont is 6 but you can. Divide tax percentage by 100 to get tax rate as a decimal. 2020 IN-152A Annualized VEP Calculator.

Your household income location filing status and number of personal exemptions. Sales Tax Calculator Sales Tax Table. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

The sales tax rate for Dover was updated for the 2020 tax year this is the current sales tax rate we are using in the Dover Vermont Sales Tax Comparison Calculator for 202223. Other local-level tax rates in the state of Vermont are quite complex compared against local-level tax rates in other states. The average cumulative sales tax rate in Middlebury Vermont is 7.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. 2021 Property Tax Credit Calculator. Calculator Tue 02162021 - 1200.

Tax Year 2020 State of Vermont Annualized Income Installment Method. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. The base state sales tax rate in Vermont is 6.

Multiply the price of your item or service by the tax rate. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Vermont Sales Tax Information Sales Tax Rates And Deadlines

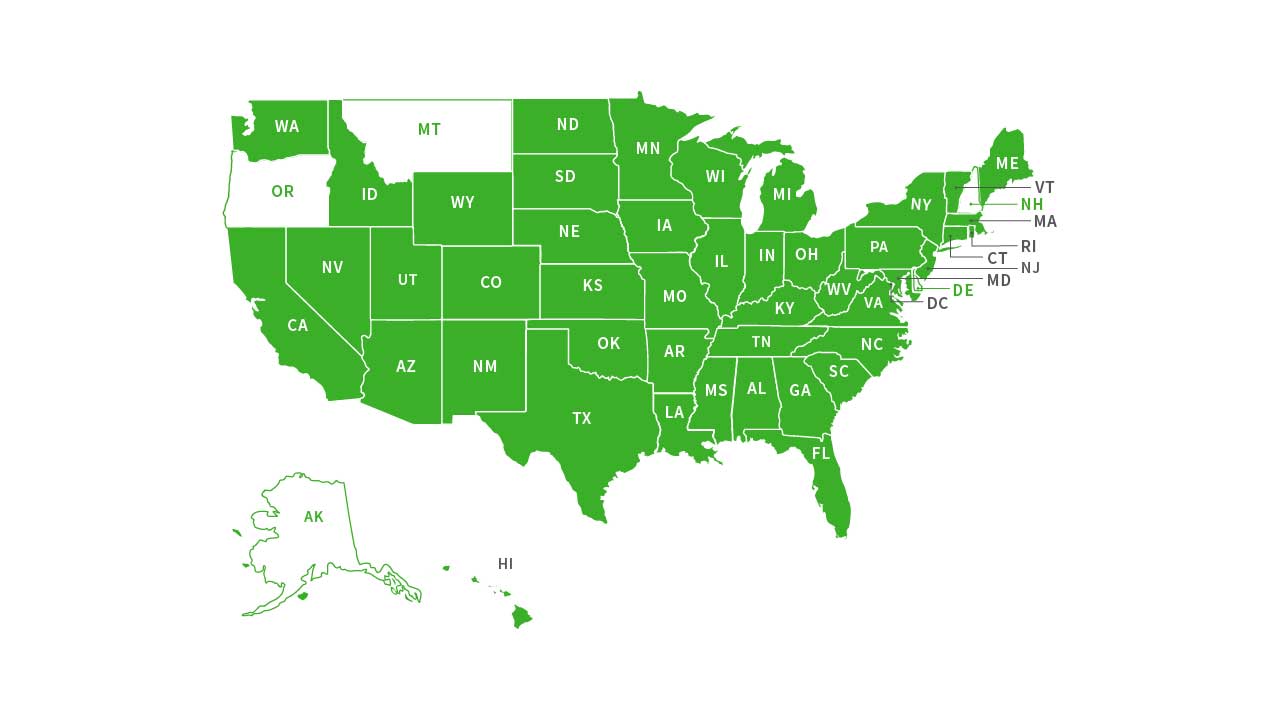

Sales Taxes In The United States Wikiwand

Vermont Sales Tax Small Business Guide Truic

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

How To Start An Llc In California 2022 Guide Resources

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Lowest Vermont Sales Tax Calculation For The Bill Of Sale Only Title Process Youtube

Vermont Property Tax Rates Nancy Jenkins Real Estate

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Vermont Income Tax Calculator Smartasset

بيك آمن بوفيه Pa Sales Tax Calculator Paperlightstudio Com

The Consumer S Guide To Sales Tax Taxjar Developers

Sales Tax On Grocery Items Taxjar

States With Highest And Lowest Sales Tax Rates

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price